Some Known Details About Mortgage Broker Vs Loan Officer

Wiki Article

Not known Factual Statements About Broker Mortgage Calculator

Table of ContentsBroker Mortgage Meaning Things To Know Before You Get ThisThe Facts About Broker Mortgage Near Me RevealedThe Best Guide To Mortgage Broker AssistantFascination About Broker Mortgage MeaningBroker Mortgage Meaning Can Be Fun For AnyoneGet This Report about Broker Mortgage MeaningWhat Does Mortgage Broker Do?5 Easy Facts About Broker Mortgage Meaning Shown

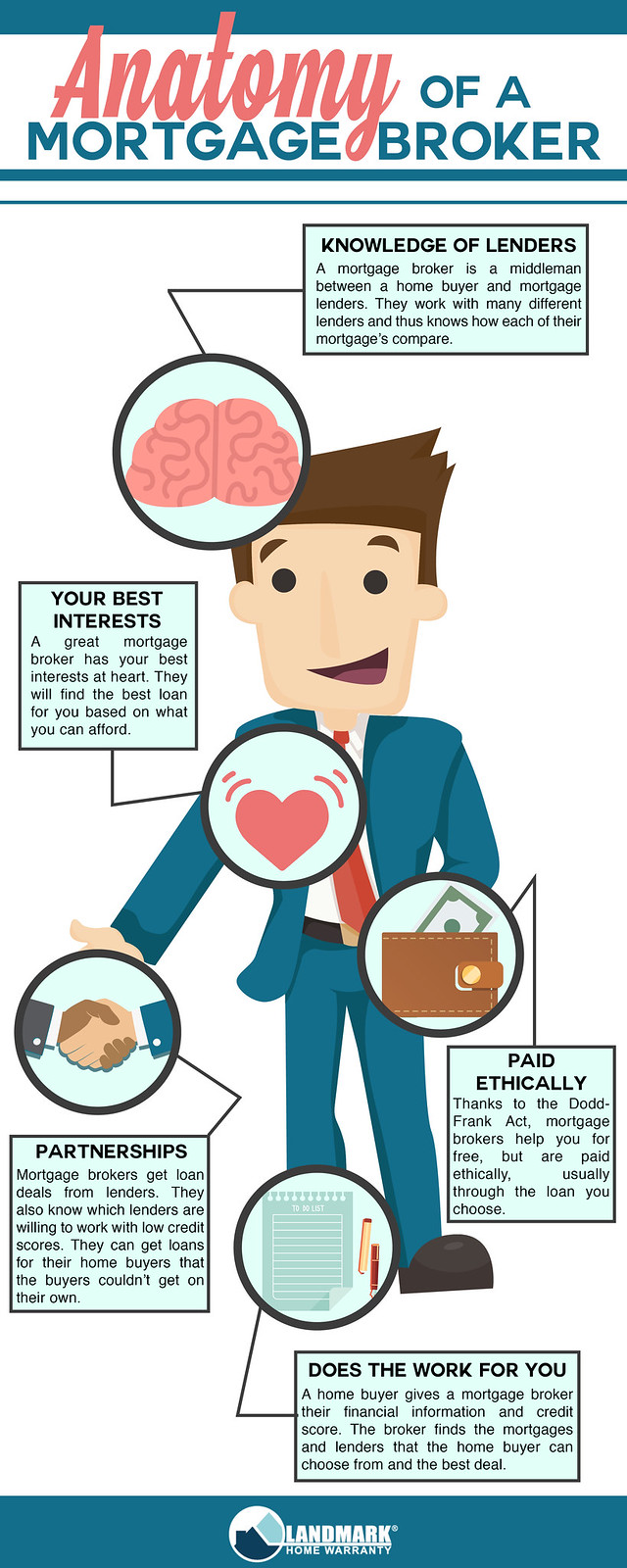

What Is a Home loan Broker? A home mortgage broker is an intermediary between a financial institution that uses financings that are secured with property as well as people curious about getting actual estate that need to obtain money in the type of a loan to do so. The home mortgage broker will collaborate with both events to get the specific accepted for the finance.A home mortgage broker normally works with various loan providers and can supply a range of car loan choices to the consumer they function with. What Does a Mortgage Broker Do? A home mortgage broker aims to finish realty deals as a third-party intermediary between a debtor and also a loan provider. The broker will accumulate information from the private as well as most likely to numerous lending institutions in order to find the most effective possible car loan for their client.

The Greatest Guide To Broker Mortgage Meaning

All-time Low Line: Do I Need A Home Loan Broker? Dealing with a home mortgage broker can save the consumer time and effort during the application procedure, as well as possibly a whole lot of cash over the life of the car loan. Additionally, some loan providers work specifically with mortgage brokers, suggesting that customers would have accessibility to lendings that would certainly otherwise not be available to them.It's crucial to analyze all the fees, both those you might need to pay the broker, in addition to any fees the broker can assist you prevent, when weighing the choice to function with a mortgage broker.

The 8-Minute Rule for Mortgage Broker

You have actually possibly heard the term "home mortgage broker" from your property agent or friends who've purchased a house. But what specifically is a home mortgage broker as well as what does one do that's different from, say, a loan policeman at a financial institution? Geek, Budget Guide to COVID-19Get response to concerns about your home mortgage, traveling, financial resources and keeping your tranquility of mind.What is a mortgage broker? A home loan broker acts as an intermediary in between you as well as possible lenders. Home loan brokers have stables of lending institutions they work with, which can make your life easier.

Mortgage Broker Job Description for Dummies

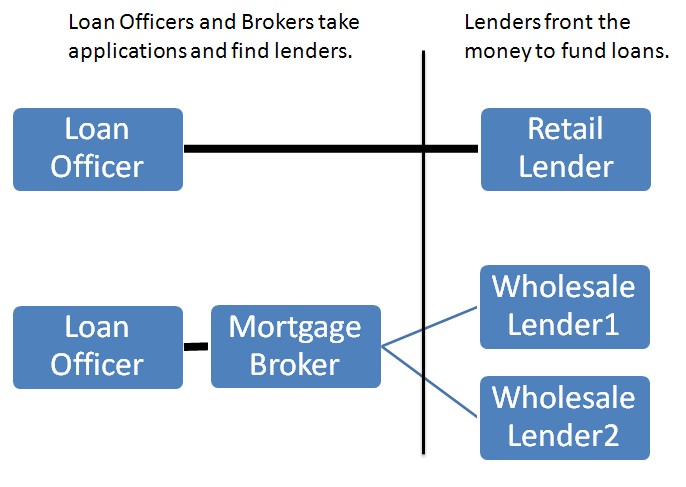

How does a home loan broker earn money? Home loan brokers are most often paid by lending institutions, sometimes by borrowers, but, by regulation, never ever both. That legislation the Dodd-Frank Act likewise forbids home loan brokers from charging hidden costs or basing their settlement on a debtor's rate of interest. You can additionally choose to pay the mortgage broker on your own.What makes home mortgage brokers various from financing officers? Lending police officers are staff members of one loan provider who are paid set wages (plus perks). Loan police officers can write just the kinds of loans their company picks to use.

Get This Report on Broker Mortgage Fees

Home mortgage brokers might be able to provide debtors accessibility to a broad option of car loan types. You can conserve time by utilizing a mortgage broker; it can take hours to apply for preapproval with different lenders, then there's the back-and-forth interaction involved in financing the lending and also ensuring the transaction stays on track.When choosing any lending institution whether with a broker or directly you'll want to pay interest to loan provider fees." After that, take the Financing Estimate you receive from each loan provider, place them side by side and compare your rate of interest rate and all of the charges and closing costs.

Our Mortgage Broker Association Statements

Exactly how do I select a home loan broker? The ideal means is to ask buddies and also loved ones for referrals, however make certain they have really utilized the broker as well as aren't just going down the name of a previous college flatmate or a remote colleague.

Mortgage Broker Job Description - An Overview

Competition and house prices will affect just how much home loan brokers earn money. What's the difference between a home loan broker as well as a lending officer? Mortgage brokers will certainly collaborate with lots of lenders to discover the most effective financing for your circumstance. Car loan policemans benefit one lending institution. Just how do I locate a home mortgage broker? The best means to locate navigate to these guys a home loan broker is with references from family members, friends and your realty agent.

description

Unknown Facts About Broker Mortgage Rates

Buying a new house is one of the most complicated events in a person's life. Quality vary greatly in regards to design, services, institution district and also, naturally, the constantly essential "place, location, area." The mortgage application procedure is a complicated facet of the homebuying procedure, especially for those without previous experience.

Can determine which problems may produce problems with one lender versus an additional. Why some purchasers avoid home mortgage brokers Often homebuyers really feel a lot more comfortable going straight to a huge financial institution to secure their car loan. In that case, customers must at the very least consult with a broker in order to recognize every one of their choices relating to the kind of car loan and the readily available rate.

Report this wiki page